Blog

Australia has been through nearly 30 years of unbroken growth.

Of course, there have been summer seasons and winter seasons, as there always will be.

But if you haven’t seen the results you’re after, you probably need to look in the mirror, as the answers lie within.

Despite the decades of Aussie...

There’s no doubt that high-paying corporate roles can accelerate your financial results, although the tax deducted at source can be withering.

The problem with so many corporate and executive roles is that they can suck up so much of your time, with core office time of 30 to 40 hours a week (if you...

As planned, we’ve spent quite a bit of time away from Noosa and over in Europe this year.

We’ve now been to more than 40 countries in our lifetimes, and we’re looking to add a couple of new countries to the growing list over the coming 6 months.

Thankfully, it’s become much easier to travel, inves...

It isn’t fashionable to hold cash or liquid funds right now, especially given the historically low level of interest rates around the developed world.

And yet, cash is important.

Cash gives you a safety buffer, it’s uncorrelated with other assets such as equities, and it gives you optionality, all...

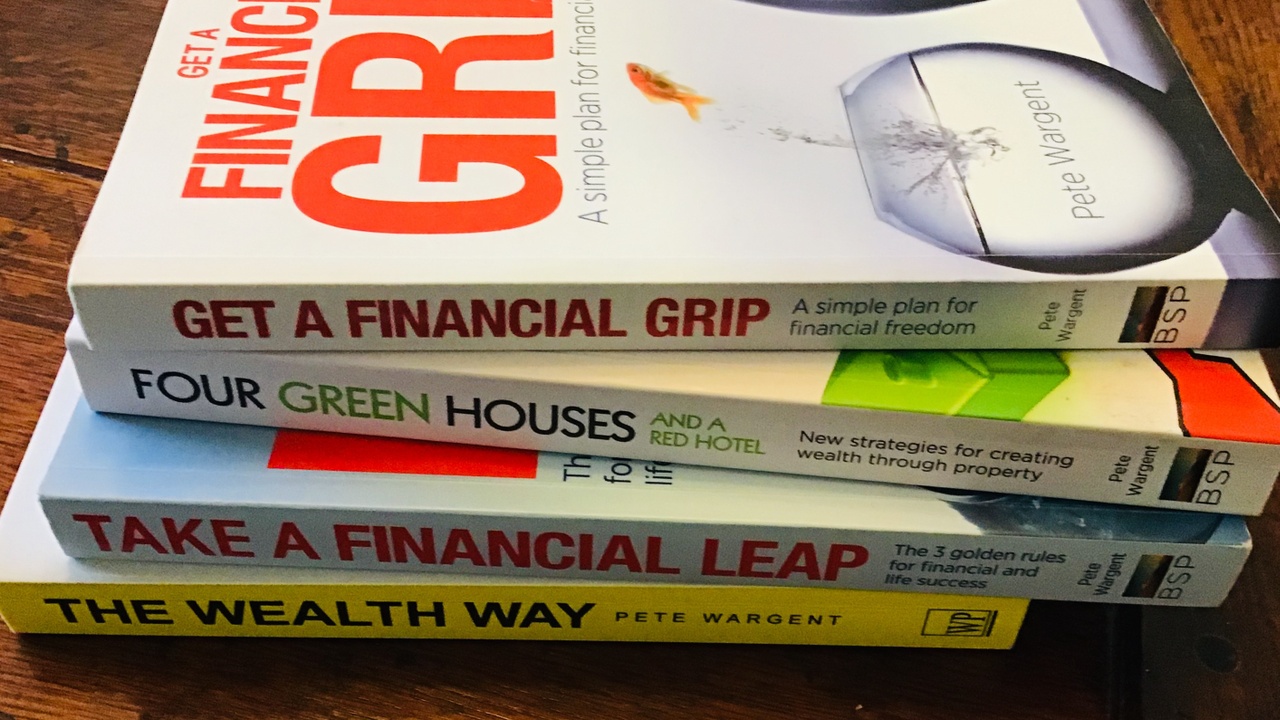

My sixth published book will be released early in the new year, via Wilkinson Publishing.

I’ve co-authored this book with my colleague Stephen Moriarty, himself a full-time investor for the past decade-and-a-half.

The book is aimed at people wanting to manage their own money, and to thrive in an e...

That markets are over-valued is barely a point worthy of debate.

There are always ways to twist & turn or justify the numbers, but the warning indicators are flashing everywhere.

Speculative activity has been rife, from cryptocurrencies to cannabis stocks.

In Australia, growth stocks have been of...

Around the world big cities are becoming more and more important.

Not only are the tech companies focusing on being close to other large businesses and the pick of the finest talent, retirement living is increasingly becoming a big-city concept too.

In London we’ve always known that housing prices...

The efficient markets hypothesis (EMH) holds that assets are rationally priced by markets as all publicly available information is immediately reflected in prices…in real time.

People like to think that they can identify bubbles, and time them.

But even in the most famous cases of all, rarely have...