Munger's mental models #7: Get investing!

Sep 10, 2024

Mental models

In this short series of blogs and videos, in honour of the late Charles Munger, I take a look at some of his most powerful mental models.

Invest!

This may seem like a simplistic point to those of you who understand why it's important to invest you capital to grow it.

Munger used a "latticework of mental models" to get ahead, but one of the simplest and most important concepts is to invest your money for the future.

And yet in many countries the population is so risk-averse that it's difficult for the average person to grow wealth.

When I was much younger I lived for a while in Germany, for example, where home ownership rates are low, the bulk of households choose to rent, and often they save their money in high-yielding savings accounts.

But you need to take some risk to reap rewards!

Japan is another country where risk-aversion is much higher, following the collapse of he the asset price bubble from 1991, and through the subsequent deflation.

Aussies, by their nature, are usually more inclined towards a gamble.

But we don't want to gamble on our respective futures.

The long-term results from property and shares show that if we can use a combination of leverage, compound growth, and time, then it's possible to achieve great things over time.

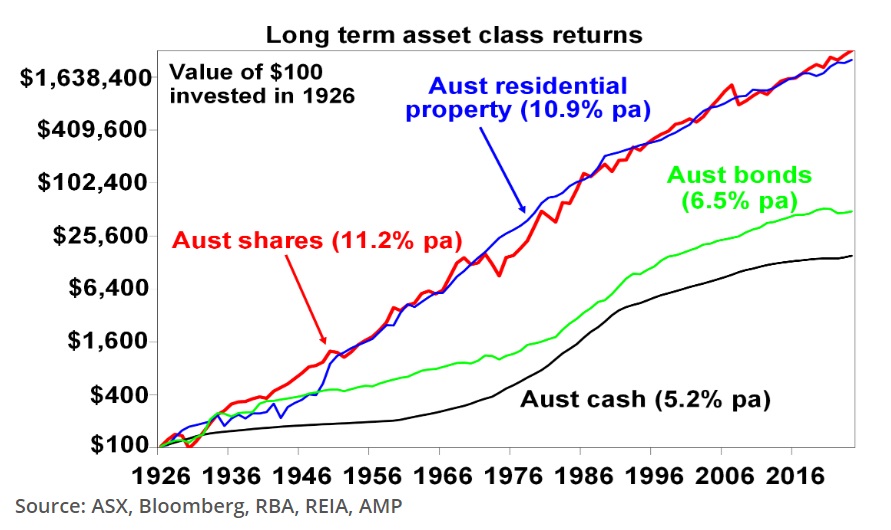

Shane Oliver from AMP shows how the total returns from property and shares have been much more similar than different over the past 100 years, at around 10-11 per cent per annum.

This makes logical sense to me.

Wealth gains tend to be capitalised into land values over time in Australia.

And if one asset class looks relatively better value than the other, then funds are moved around accordingly.

As such the returns from property shares have been very similar over more than a century.

Morgan Housel wrote that even with average investment returns you can achieve great things over time because of the effects of compounding.

And indeed, Buffett and Munger created most of their wealth after the age of 65, due to the 'hockey stick' effect and the most powerful increases in net worth coming later in the journey.

I discussed this a little further in the short video below:

P.S. Whenever you’re ready…here are 4 ways I can help you manage your own money and go next level wealth:

- Boom or Bust – 20 minute online workshop for investors

Register for my next free online training - Boom or Bust? How to change your investment plan - book in here

You also download a free copy of my e-book The Only 6 Ways to Become Wealthy here.

- Subscribe to our Top 10 Podcasts for Investors

Listen in to our podcasts

The Australian Property Podcast is one of Australia's biggest business podcasts, with well over 50,000 audio downloads per month.

And our enormously popular Low Rates High Returns Show is also available on Spotify.

- Subscribe for my free daily blog

Subscribe for my free daily blog with over 3.7 million hits here.

You can also catch up with me daily on Twitter here, where I'm active daily and have over 14,500 followers.

- Work with me privately

For a limited time you can book in a free diagnosis call with me here.

If you’d like to work directly with me directly to help you map out and action your next level wealth plan… just send an email to pete@gonextlevelwealth.com.au with the word “private”…tell me a little about your situation and what you’d like help with, and I’ll get you all the details!